Brave New World: How will US rebuild its infra & why you should take ESG investing seriously

SECTIONSBrave New World: How will US rebuild its infra & why you should take ESG investing seriouslyET CONTRIBUTORSLast Updated: Jun 06, 2021, 09:11 AM ISTSHAREFONT SIZESAVEPRINTCOMMENTSynopsis

Ritesh Jain believes global GDP growth will disappoint in the second half of the year.

Ritesh Jain

Global Macro Investor & One of Top 3 Global LinkedIn Influencers on Economy and Finance, Mumbai

He is a trend watcher, Global Macro investor and Blogger at worldoutofwhack.com. He has over 20 years of experience in financial markets, bonds, equities, gold, and derivatives. He muses about global macro investment opportunities, economics, business, and financial issues.Ritesh Jain, a Dalal Street veteran, trend watcher and Global Macro Investor, captures global macro investment opportunities and economic, business and financial trends with charts and commentaries in this space.

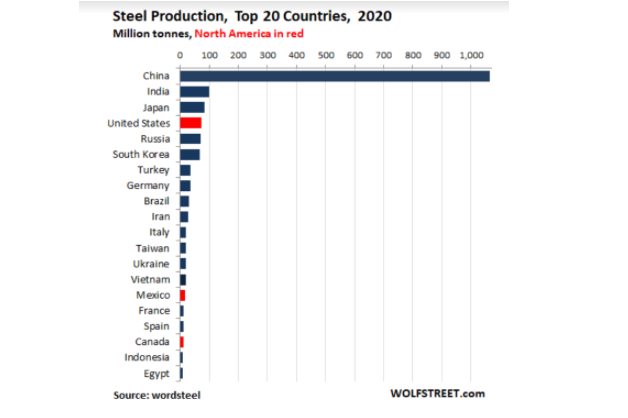

How will US rebuild its infra? It does not produce any steel

Therefore, buying fixed asset owners makes sense

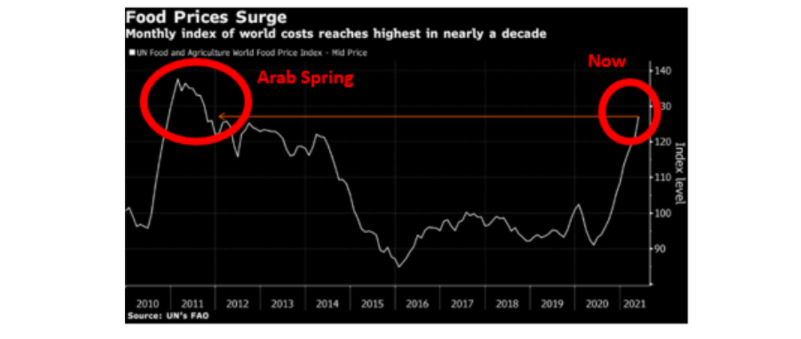

Remember “Arab spring”

Global Food Prices surge to the same level as onset of the ‘Arab Spring’

Global GDP growth will disappoint in second half of the year

Bloomberg highlights that the number of firms concerned about rising input costs is the highest in a decade. The gap between PPI and CPI is towards the highest since the early 1990s. The WSJ says that, buffeted by the rising costs, some manufacturers are refusing to accept orders or are even considering shutting down operations temporarily, moves that could put more strain on global supply chains.

“If input cost pressure persists, more manufacturers in China will either be forced to halt production, or pass it on to consumers at home and abroad,” said Standard Chartered. “Our research indicates that there’s a strong correlation between inflation in China and consumer inflation in the US.”

If margin pressures are so severe that companies may have to close or stop accepting orders, it would suggest that real GDP growth is peaking and will slow.

Investors need to start taking ESG seriously even if does not make any sense

ET CONTRIBUTORSESG assets may hit $53 trillion by 2025, a third of global AUM

( Originally published on Jun 05, 2021 )(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com.)

READ MORE NEWS ON

Brave New WorldFixed AssetsUS InfraCovidGlobal Macro InvestorUS EconomyUS ManufacturingCoronavirus(What’s moving Sensex and Nifty Track latest market news, stock tips and expert advice on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.ADD COMMENTNew on Get In-depth Reports on 4,000+ Stocks, updated daily

Subscribe to ETPrimeIN THE SPOTLIGHTHere’s your chance to study medicine abroad

WHAT’S YOUR MARKET SCORE?QUESTION: 1/3HIGHEST SCORE: 300Who is the current Chairman of Sebi?Subhash Chandra GargShaktikanta DasUK SinhaAjay Tyagi

- Growth at Reasonable PriceHDFC2585.75-1.27%Indus Towers252.451.73%Supreme Ind.2229.550.03%Ajanta Pharma1951.45-0.20%

- High Dividend YieldIrcon Intl.47.851.38%Welspun Corp155.855.48%Rites264.656.11%Balmer Lawrie143.955.07%

- Mid-cap Growth StocksMastek Ltd1994.402.05%Dr Lal Pathlabs2968.003.48%Hikal Ltd502.8013.59%Ipca Labs2042.35-0.80%

- Attractive BluechipsIndus Towers252.451.73%Hindustan Zinc339.851.84%HAL1065.350.27%Muthoot Finance1513.150.25%

Why follow tips? Choose your winners rationally in 3 simple steps!START NOW

- RELATED

- MOST READ

- MOST SHARED

- Brave New World: Commodity economics, inflation dynamics and Apple earnings

- Brave New World: Tail risks, sectoral rotation and the problem with gold

- Brave New World: Agro-commodities in for bull market; stay-at-home trade picking up

- Brave New World: Stock investment in last 5 months more than that in last 12 years

- Brave New World: Corporate bond spreads continue to support higher equity markets

DISCOVER MUTUAL FUNDS

- All Mutual FundsTop Tax Saver FundsBetter Than Fixed DepositsLow Cost High Return Funds

- Best Hybrid FundsBest Large Cap FundsSIP’s starting Rs. 500Top Performing Mid Caps

- Promising Multi Cap FundsTop Rated Funds

Trending in MarketsCryptocurrencyStock ScreenerSensexStock MarketStock RecommendationsIPOUpcoming IPOGold RateTop GainersRupee Vs DollarShare MarketSilver PriceNifty 50Nifty BankInfosys Share PriceCrude Oil Price

Not to be Missed

Financial Times, New York Times, Bloomberg News websites downNew national vaccine guidelines issuedFlipkart JV to bring Toys”R”Us to IndiaCEC writes to Law Min about electoral reforms‘2nd wave to impact rural loan collections’India keeps watch on Chinese jet exerciseSevere Covid may reduce brain’s gray matter800 arrested worldwide in huge crime stingAn Insight into ETFs – How they help in long term wealth creationFree jabs, food to cost India $11 bn moreMost cos expect hiring numbers to riseWhy Amazon is confronting Mukesh AmbaniAll about the latest twist in Franklin storyFuel price rise paused againNEXT STORY

Max Life, Tata AIA make vaccination must for term life

SECTIONSMax Life, Tata AIA make vaccination must for term lifeBy Ashwin Manikandan, ET BureauLast Updated: Jun 08, 2021, 03:22 PM ISTSHAREFONT SIZESAVEPRINTCOMMENTSynopsis

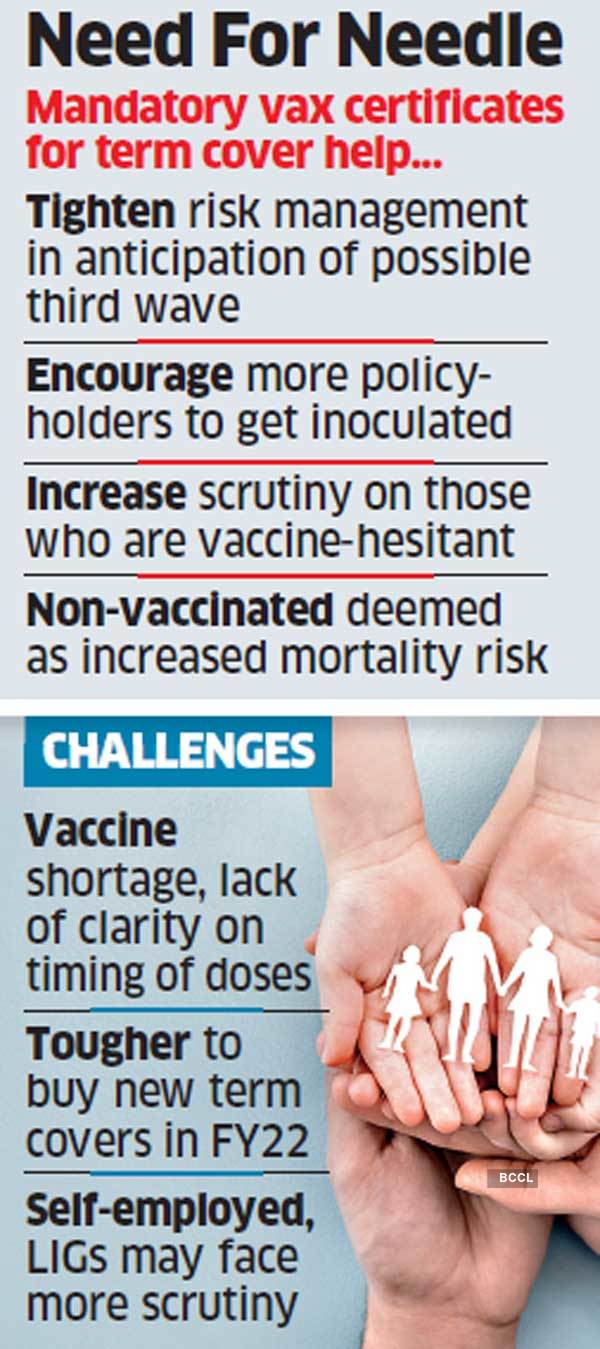

While Max Life is issuing term covers to people over the age of 45 only if they are able to produce their final vaccination certificates, Tata AIA is issuing policies, irrespective of age, only to those who have received their first shot. The trigger for these conditions for issuing new term policies seems to have originated from reinsurers such as Munich Re and Swiss Re, who are the biggest underwriters of risk for the domestic insurance companies.

Max Life and Tata AIA have taken the lead in asking for mandatory Covid-19 vaccine certificates for buyers of term life insurance — opening the doors for other insurers to follow suit to reduce future claims payouts, but depriving cover to those who have not yet been inoculated.

While Max Life is issuing term covers to people over the age of 45 only if they are able to produce their final vaccination certificates, Tata AIA is issuing policies, irrespective of age, only to those who have received their first shot.

The trigger for these conditions for issuing new term policies seems to have originated from reinsurers such as Munich Re and Swiss Re, who are the biggest underwriters of risk for the domestic insurance companies.

“To ensure the highest degree of financial protection to our policyholders, we ensure their interests are protected at all times,” a Tata AIA spokesperson said in reply to ET’s emailed queries on the topic. “Our practices and policies reflect emerging realities. We continue to stay consumer-focused as well as prudent in our practices.”

A Max Life spokesperson said that the company “continues to issue new term life policies to those who have not received the Covid 19 vaccine.”

“We have not mandated vaccination certificates to issue term insurance policies to our customers. We continue to be committed to the wellbeing of our consumers and stakeholders, and urge them to get vaccinated to ensure their safety and that of their families,” the Max Life spokesperson added in response to ET’s queries.

Scrutinising policyholders on their vaccination status could potentially solve two purposes for insurance companies.

More Scrutiny for Hesitant

First, it would help insurers tighten risk management, where a non-vaccinated policyholder is deemed riskier to underwrite, thereby saving the insurer from increased claims burden in the event of a third wave. Second, such an enquiry process could also help companies differentiate policyholders that are by nature “vaccine-hesitant,” and enforce higher levels of scrutiny for them.

“The logic is similar to how buying insurance is harder for, say, a long-time smoker. Insurance companies could operate under the assumption that those not getting access to vaccines after a certain period of time could be doing so because they don’t want to get vaccinated at all,” said an industry executive.

On the flip side however, this will negatively impact people who have not been inoculated yet. This could be because of the shortage of vaccines and in cases where a final vaccination certificate is sought, a person will have to wait for 84 days before he can take the second shot. As of Sunday, only 23 crore people had taken their first shot in a country of 1.38 billion.

“Even a single shot displays intent, and insurers should not penalise customers for not being able to access vaccines when there is shortage,” said Mahavir Chopra, chief executive of Beshak.org, a consumer awareness platform for insurance.

In a country with an already poor insurance cover, the purchase of a safety net has become more expensive, with premia shooting up after claims surged due to virus infections.

Cooling off Period

As part of tightening the procedure, ICICI Prudential, Tata AIA and Aegon Life have also introduced a seven to 15 day “cooling off period” post vaccination, where new policy applications are being temporarily deferred.

“It has been observed, at times, that after being vaccinated against Covid-19, a few individuals display hypersensitivity or other reactions,” said an ICICI Pru spokesperson. “Typically, this takes anywhere between seven to 15 days to subside and hence, a cooling off period is needed. At ICICI Prudential Life, we have a cooling off period of just seven days.”

Aegon Life didn’t respond to ET’s queries. Tata AIA didn’t comment on its cooling off period.

READ MORE NEWS ON

ICICI Prudential LifeSwiss ReTata AIAMax LifeVaccination(What’s moving Sensex and Nifty Track latest market news, stock tips and expert advice on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.ADD COMMENTNew on Get In-depth Reports on 4,000+ Stocks, updated daily

Subscribe to ETPrimeIN THE SPOTLIGHTHere’s your chance to study medicine abroad

- Growth at Reasonable PriceHDFC2554.50-1.21%Indus Towers257.401.96%Supreme Ind.2266.551.66%Ajanta Pharma1969.050.90%

- High Dividend YieldIrcon Intl.48.601.57%Welspun Corp155.10-0.48%Rites268.251.36%Balmer Lawrie144.200.17%

- Mid-cap Growth StocksMastek Ltd2011.650.86%Dr Lal Pathlabs2983.200.51%Hikal Ltd497.80-0.99%Ipca Labs2036.75-0.27%

- Attractive BluechipsIndus Towers257.401.96%Hindustan Zinc338.60-0.37%HAL1070.100.45%Muthoot Finance1491.30-1.44%

Why follow tips? Choose your winners rationally in 3 simple steps!START NOW

- RELATED

- MOST READ

- MOST SHARED

- Covid-19 shot before cover: Max Life, Tata AIA make vaccination must for term life

- Axis Bank transformation head Naveen Tahilyani quits to join Tata AIA as India head

- Tata AIA appoints Rishi Srivastava as CEO & MD

- Tata AIA launches m-Insurance in partnership with TTSL

- Our claim settlement ratio is the second best in the insurance industry, thanks to technology: TataAIA’s Yusuf Pachmariwala

- Max Life, Birla Sun Life, Tata AIA shortlisted for IDBI Federal stake

DISCOVER MUTUAL FUNDS

- All Mutual FundsTop Tax Saver FundsBetter Than Fixed DepositsLow Cost High Return Funds

- Best Hybrid FundsBest Large Cap FundsSIP’s starting Rs. 500Top Performing Mid Caps

- Promising Multi Cap FundsTop Rated Funds

Trending in MarketsCryptocurrencyStock ScreenerSensexStock MarketStock RecommendationsIPOUpcoming IPOGold RateTop GainersRupee Vs DollarShare MarketSilver PriceNifty 50Nifty BankInfosys Share PriceCrude Oil Price

Not to be Missed

Financial Times, New York Times, Bloomberg News websites downNew national vaccine guidelines issuedFlipkart JV to bring Toys”R”Us to IndiaCEC writes to Law Min about electoral reforms‘2nd wave to impact rural loan collections’India keeps watch on Chinese jet exerciseSevere Covid may reduce brain’s gray matter800 arrested worldwide in huge crime stingAn Insight into ETFs – How they help in long term wealth creationFree jabs, food to cost India $11 bn moreMost cos expect hiring numbers to riseWhy Amazon is confronting Mukesh AmbaniAll about the latest twist in Franklin storyFuel price rise paused againPower consumption grows 12.6% in JunePace of biz activity sees uptick: NomuraOcugen pays $15 mn for Covaxin rightsNew infections dip below 1-lakh markApple talking to CATL, BYD for EV batteriesNEXT STORY

Sebi fines ex-Fidelity trader, 10 others

SECTIONSSebi fines ex-Fidelity trader, 10 othersTNNLast Updated: Jun 08, 2021, 06:45 AM ISTSHAREFONT SIZESAVEPRINT1COMMENTSynopsis

Sebi on Monday barred 11 entities from the market for front-running trades in Fidelity Group, a foreign portfolio investor (FPI), and asked these to disgorge nearly Rs 2.1 crore of illegal profits.

Mumbai: Sebi on Monday barred 11 entities from the market for front-running trades in Fidelity Group, a foreign portfolio investor (FPI), and asked these to disgorge nearly Rs 2.1 crore of illegal profits. According to the order, Vaibhav Dhadda, a trader with Fidelity Group, along with his mother Alka and sister Arushi, were front-running the exact trades that the FPI employee was putting in.

The case relates to several trades carried out by these entities in 2019 using insider information passed by Vaibhav to other entities either directly or indirectly. Through an interim order, Sebi had in December 2019 banned these entities from the market.

Subsequent investigations by the markets regulator found that another eight people were also involved with members of the Dhadda family in these trades and, hence, the order on disgorgements as also the bans.

DID YOU KNOW?

Stock score of ICICI Securities Ltd moved up by 2 in 3 months.VIEW LATEST STOCK REPORT »

Sebi’s investigations showed that Vaibhav, then an employee with Fidelity, and his wife were residents in Hong Kong and the internet trading accounts for some of those charged in the case were operated out of the same island city. The trades by the Fidelity Group entities were carried out through top foreign and domestic brokerages like Goldman Sachs, UBS Securities, Citigroup and ICICI Securities, and Vaibhav was aware of these trades.

On the other hand, Alka and Arushi Dhadda were aware of the trades by the FPI and took positions ahead of those, thus indulging in front-running. And after Fidelity’s trades were executed, the front-runners sold off their positions and made some quick gains. “It appeared that Vaibhav Dhadda had prima facie front-run various entities of Fidelity Group by placing orders through the trading accounts of Alka Dhadda and Arushi Dhadda,” the Sebi order said.

The Sebi order showed that the entities together had made a total illegal gain of nearly Rs 3.6 crore. Of this, Rs 1.9 crore has already been impounded by the regulator. The balance amount from the illegal gains from front-running and also interest on it adds up to about Rs 2.1 crore. Sebi show-caused the entities as to why they should not be banned from the market for indulging in these illegal activities.

The entities were also directed not to dispose of any assets, movable or immovable, without the prior permission of Sebi, the order said.

READ MORE NEWS ON

Vaibhav DhaddaGoldman SachsCitigroupFidelityICICI SecuritiesSebiFPI(What’s moving Sensex and Nifty Track latest market news, stock tips and expert advice on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

1 COMMENTS ON THIS STORY

| Suresh Kamath6 hours agoSEBI the MOST Tough Regulatory in INDIA having Powers much more than SEC of USA but very POOR in picking up such OFFENDERS who misuse their Office and LOOT the PUBLIC and are JUST Fined and NEVER JAILED nor their ASSETS Seized for all such OFFENCE and hence encourages ALL others to try such LOOT and SEBI MUST be very SEVERE on any Market OFFENCE and deter ANY ONE to try such LOOT of MONEY |

VIEW COMMENTS ADD COMMENTSNew on Get In-depth Reports on 4,000+ Stocks, updated daily

Subscribe to ETPrimeIN THE SPOTLIGHTHere’s your chance to study medicine abroad

- Growth at Reasonable PriceHDFC2554.50-1.21%Indus Towers257.401.96%Supreme Ind.2266.551.66%Ajanta Pharma1969.050.90%

- High Dividend YieldIrcon Intl.48.601.57%Welspun Corp155.10-0.48%Rites268.251.36%Balmer Lawrie144.200.17%

- Mid-cap Growth StocksMastek Ltd2011.650.86%Dr Lal Pathlabs2983.200.51%Hikal Ltd497.80-0.99%Ipca Labs2036.75-0.27%

- Attractive BluechipsIndus Towers257.401.96%Hindustan Zinc338.60-0.37%HAL1070.100.45%Muthoot Finance1491.30-1.44%

Why follow tips? Choose your winners rationally in 3 simple steps!START NOW

- RELATED

- MOST READ

- MOST SHARED

- Wealth managers still in crypto ‘education mode’: Fidelity

- Fidelity launches brokerage account aimed at 13- to 17-year-olds

- Fidelity offers 5-day of family care leave

- Fidelity halves valuation of Ant Group after Chinese crackdown

- Fidelity halves valuation of Ant Group after Chinese crackdown: Report

DISCOVER MUTUAL FUNDS

- All Mutual FundsTop Tax Saver FundsBetter Than Fixed DepositsLow Cost High Return Funds

- Best Hybrid FundsBest Large Cap FundsSIP’s starting Rs. 500Top Performing Mid Caps

- Promising Multi Cap FundsTop Rated Funds

Trending in MarketsCryptocurrencyStock ScreenerSensexStock MarketStock RecommendationsIPOUpcoming IPOGold RateTop GainersRupee Vs DollarShare MarketSilver PriceNifty 50Nifty BankInfosys Share PriceCrude Oil Price

Not to be Missed

Financial Times, New York Times, Bloomberg News websites downNew national vaccine guidelines issuedFlipkart JV to bring Toys”R”Us to IndiaCEC writes to Law Min about electoral reforms‘2nd wave to impact rural loan collections’India keeps watch on Chinese jet exerciseSevere Covid may reduce brain’s gray matterNEXT STORY

7 reasons market is discounting short-term Covid pain for long-term gain of higher profits

SECTIONS7 reasons market is discounting short-term Covid pain for long-term gain of higher profitsBy Nilesh Shah, TOI.inLast Updated: Jun 08, 2021, 07:54 AM ISTSHAREFONT SIZESAVEPRINTCOMMENTSynopsis

Stock markets are on a bull run. Yet India is only just coming out of a brutal Covid second wave and many fear a third wave. And the economy has taken another hit.

RELATED

- Nifty at record high but some sectors remain undervalued: Sunil Subramaniam

- Stock market watch: What to expect from the week ending June 11, 2021

- Think the global minimum tax will bite? Watch the stock market

Stock markets are on a bull run. Yet India is only just coming out of a brutal Covid second wave and many fear a third wave. And the economy has taken another hit. Why are markets so bullish?

Are markets ‘insensitive’ to people’s suffering? Or are Sensex and Nifty bubbles about to burst?

The smarter answer may be that markets are discounting short-term pains of Covid for long-term gain of higher corporate profits.

Undoubtedly the second wave of Covid-19 has adversely impacted everything from jobs to businesses. For some time, consumers will hesitate to spend money. They are likely to defer big ticket purchases like TVs and cars. The MSME sector which was just recovering from the first wave has been hit hard by lockdowns. Rural India is likely to be adversely affected by the wider spread of Covid compared to the first wave.

The one silver lining of the second wave is the use of regional lockdowns over a national lockdown, resulting in less disruption to businesses.

So, what are markets betting on when they are rising? Here are seven things markets now believe in.

Vax Effect: Accelerated vaccination, rapid expansion in healthcare infrastructure and Covid-appropriate behaviour will normalise economic activities by the second quarter of 2021-22. And that the third wave will be less damaging than the second in terms of deaths, and disruption to economic activities.

India Inc Profits: Bigger (listed) companies will grab market share from smaller (unlisted) companies over the medium term, as the former are in a better financial position. This trend of the big becoming bigger will lead to higher profits for listed companies. Corporate profitability in 2021-22 and beyond will see acceleration similar to that in 2020-21. In 2020-21’s third quarter, corporate profit grew to Rs 2,09,795 crore, surpassing expectations. The fourth quarter of the last financial year is likely to witness another all-time high-profit number.

Few Options Better Than Stocks: There are few good investible options for domestic investors. Lower returns on bank deposits, gold and real estate are likely to result in a higher funds flow towards equities. Investors are willing to take higher risks as they have tasted success on investments made since March 2020.

Foreign Money: Foreign portfolio investors (FPIs) became aggressive buyers of Indian equities in the second half of 2020-21. FPIs are likely to be neutral on India for the next quarter as India’s peers, which have opened their economy, will post better results. However, over a longer term FPIs are likely to be net buyers of Indian equities as our growth recovers. Lower interest rates and high global liquidity supported by non-stop printing of money by central banks around the world is also likely to result in higher FPI flows over the longer term.

Good Work by RBI: RBI has done an excellent job in managing the rupee, interest rates, financial market stability and the large borrowing programme of the government. RBI’s deft management of the economy and financial markets will support faster economic growth and higher corporate profits.

Stimulus is Coming: Markets are expecting a fiscal stimulus as the economy opens up. It can push 2021-22 GDP growth higher than expected.

Manufacturing, Housing Boom: GDP growth will reach high single digits beyond 2022-23 thanks to the production-linked incentive (PLI) scheme and a housing sector revival. The PLI scheme can act as a catalyst for India’s emergence as a manufacturer to the world. The housing sector has come down from a double-digit contribution to India’s GDP to mid-single digits. But now, affordability has increased due to stagnation in house prices, housing loans are available at record low interest rates, and work from home has created demand for new housing. Stamp duty concessions are also helping.

True, valuations are high in Indian markets, but they look reasonable against global averages. India’s market cap/ GDP ratio is 104%, higher than the historical average of 78%, but lower than the global market cap/ GDP ratio of 131 %.

In a fairly valued market, in order to make money investors will have to be disciplined enough to differentiate noise from news, rumours from facts and have the conviction to invest in volatile markets for the longer term.

Time will prove if markets’ current bullishness is wrong. Right now, your assessment will depend on whether you believe the wisdom that markets price every known risk.

( The writer is Managing Director, Kotak Mahindra Asset Management. Views are personal)

READ MORE NEWS ON

Nilesh ShahBull RunStock MarketCovid 19Rural IndiaFPIKotak Mahindra Asset Management(What’s moving Sensex and Nifty Track latest market news, stock tips and expert advice on ETMarkets. Also, ETMarkets.com is now on Telegram. For fastest news alerts on financial markets, investment strategies and stocks alerts, subscribe to our Telegram feeds.)

Download The Economic Times News App to get Daily Market Updates & Live Business News.

4 COMMENTS ON THIS STORY

| Suresh Kamath6 hours agoIt is said ALL Person dream of the Future BUT such BIG DREAMERS dream TRULY a BIGGER MACRO Dreams and God willing could be TRUE on a Long Term Basis.Good Luck and all the best to INVESTORS |

| Shaleen Nath Tripathi6 hours agoLonger time horizon means more time for uncertainty… Analysts could make better prediction in the short run based on evidences… They must highlight the rational expectations that could prove to be self-fulfilling… |

| Casey Fernandes8 hours agoIs he looking for a bride? |

VIEW COMMENTS ADD COMMENTSNew on Get In-depth Reports on 4,000+ Stocks, updated daily

Subscribe to ETPrimeIN THE SPOTLIGHTHere’s your chance to study medicine abroad

- Growth at Reasonable PriceHDFC2554.50-1.21%Indus Towers257.401.96%Supreme Ind.2266.551.66%Ajanta Pharma1969.050.90%

- High Dividend YieldIrcon Intl.48.601.57%Welspun Corp155.10-0.48%Rites268.251.36%Balmer Lawrie144.200.17%

- Mid-cap Growth StocksMastek Ltd2011.650.86%Dr Lal Pathlabs2983.200.51%Hikal Ltd497.80-0.99%Ipca Labs2036.75-0.27%

- Attractive BluechipsIndus Towers257.401.96%Hindustan Zinc338.60-0.37%HAL1070.100.45%Muthoot Finance1491.30-1.44%

Why follow tips? Choose your winners rationally in 3 simple steps!START NOW

- MOST READ

- MOST SHARED

- Day trading guide: 2 stock recommendations

- Tweet Buster: How a demerger can unlock value for ITC shareholders

- IDFC First Bank might turn out to be the dark horse

- Despite Q4 loss, this electrode maker is Jefferies’ multibagger bet for FY22

- 15 tips from ‘super-investor’ Schloss a stock investor must always follow

DISCOVER MUTUAL FUNDS

- All Mutual FundsTop Tax Saver FundsBetter Than Fixed DepositsLow Cost High Return Funds

- Best Hybrid FundsBest Large Cap FundsSIP’s starting Rs. 500Top Performing Mid Caps

- Promising Multi Cap FundsTop Rated Funds

Trending in MarketsCryptocurrencyStock ScreenerSensexStock MarketStock RecommendationsIPOUpcoming IPOGold RateTop GainersRupee Vs DollarShare MarketSilver PriceNifty 50Nifty BankInfosys Share PriceCrude Oil Price